Get divorce ready

get financially prepared

for divorce

Get divorce ready

get financially

prepared for divorce

Divorce 1-on-1

Consulting PackagE Options

Get Divorce Ready Team

Base Financial Package

$4000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Bonus

Get Divorce Ready Team + Mediation Session

$5000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Bonus

Additional Benefits

Mediation Prep

8 Hour Session with a Licensed Mediator or Parenting Plan Guidance

Comprehensive Financial Assessment

We understand that divorce can be a complex and stressful process. We will provide a thorough evaluation of your financial situation to ensure that you have a solid understanding of your assets and liabilities and how they may be affected by the divorce process.

Asset Division Advisory

Our team will help you identify, categorize and value marital and non-marital assets, ensuring a fair and accurate distribution of property and assets between you and your spouse.

Analyzing Settlement Proposals

We will review your settlement proposals to make sure they align with your short term and future goals.

Retirement Plan Evaluation

We offer expert guidance on dividing pension and 401k plans through a QDRO (Qualified Domestic Relations Order) review. This service ensures that your retirement savings are protected and fairly distributed during the divorce process.

Spousal and Child Support Analysis

Our professionals will evaluate and advise on the financial implications of spousal and child support, taking into consideration factors such as income, expenses, and tax implications.

Tax Planning and Consulting

Gain a clear understanding of how divorce can impact your tax situation. We will review your financial circumstances and provide strategic recommendations to minimize your tax liability.

Cash Flow and Budgeting Assistance

Divorce can lead to significant changes in cash flow and budgeting. Our team will analyze your post-divorce financial landscape, helping you develop a realistic budget to regain control of your finances. We will also run cash flow scenarios to determine when you can retire, if you need to work, or if you need to reduce your expenses in the future.

Insurance Needs Assessment

We identify potential gaps in your insurance coverage and recommend solutions to protect your financial well-being, considering your unique circumstances, such as health, life, disability, umbrella and property insurance.

Post-Divorce Financial Planning

We will help you create a comprehensive post-divorce financial plan, including investment strategies, estate planning, retirement planning, and long-term financial goal setting, ensuring that you have a clear path to financial success.

Education Planning

If you have children, we recognize the importance of investing in their future education. Our professionals will help you develop a customized education savings plan that ensures your children's educational needs are met post-divorce.

Bonus

Access to our paid membership community with weekly group support and resources & we will offer unlimited calls throughout this process.

Divorce 1-on-1

Consulting Package Options

One-time Payment

$5000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

One-time Payment

$5000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

4 Monthly Payments

$1250/mo

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

4 Monthly Payments

$1250/mo

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

Get Divorce Ready Team

Base Financial Package

$4000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Bonus

Get Divorce Ready Team + Mediation Session

$5000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Bonus

Additional Benefits

Mediation Prep

8 Hour Session with a Licensed Mediator or Parenting Plan Guidance

One-time Payment

$5000

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

4 Monthly Payments

$1250/mo

Comprehensive Financial Assessment

Asset Division Advisory

Analyzing Settlement Proposals

Retirement Plan Evaluation

Spousal and Child Support Analysis

Tax Planning and Consulting

Cash Flow and Budgeting Assistance

Insurance Needs Assessment

Post-Divorce Financial Planning

Education Planning

Mediation Prep

8 Hour Session with Mediator or Parenting Plan Guidance

Bonus

Comprehensive Financial Assessment

We understand that divorce can be a complex and stressful process. We will provide a thorough evaluation of your financial situation to ensure that you have a solid understanding of your assets and liabilities and how they may be affected by the divorce process.

Asset Division Advisory

Our team will help you identify, categorize and value marital and non-marital assets, ensuring a fair and accurate distribution of property and assets between you and your spouse.

Analyzing Settlement Proposals

We will review your settlement proposals to make sure they align with your short term and future goals.

Retirement Plan Evaluation

We offer expert guidance on dividing pension and 401k plans through a QDRO (Qualified Domestic Relations Order) review. This service ensures that your retirement savings are protected and fairly distributed during the divorce process.

Spousal and Child Support Analysis

Our professionals will evaluate and advise on the financial implications of spousal and child support, taking into consideration factors such as income, expenses, and tax implications.

Tax Planning and Consulting

Gain a clear understanding of how divorce can impact your tax situation. We will review your financial circumstances and provide strategic recommendations to minimize your tax liability.

Cash Flow and Budgeting Assistance

Divorce can lead to significant changes in cash flow and budgeting. Our team will analyze your post-divorce financial landscape, helping you develop a realistic budget to regain control of your finances. We will also run cash flow scenarios to determine when you can retire, if you need to work, or if you need to reduce your expenses in the future.

Insurance Needs Assessment

We identify potential gaps in your insurance coverage and recommend solutions to protect your financial well-being, considering your unique circumstances, such as health, life, disability, umbrella and property insurance.

Post-Divorce Financial Planning

We will help you create a comprehensive post-divorce financial plan, including investment strategies, estate planning, retirement planning, and long-term financial goal setting, ensuring that you have a clear path to financial success.

Education Planning

If you have children, we recognize the importance of investing in their future education. Our professionals will help you develop a customized education savings plan that ensures your children's educational needs are met post-divorce.

Bonus

Access to our paid membership community with weekly group support and resources & we will offer unlimited calls throughout this process.

Who are we?

Marissa & James Greco

Are dedicated to helping women navigate the financial complexities of pre and post-divorce life. As fiduciary financial planners and Certified Retirement Specialists, we bring 10 years of experience, industry knowledge, and personalized guidance to empower women during this challenging time. Our mission is to help you achieve financial security and independence through personalized financial planning and sound wealth management strategies.

Angela Deaton

A dedicated Senior Loan Officer who loves helping borrowers reach their goals. Although she and her team are located in the heart of Dallas, Texas – they finance loans all across the country. With a vast knowledge of different loan products, The Deaton Team focuses on educating clients about their options and guiding them through the home loan process. Angela got her start in the mortgage industry over 19 years ago, and her commitment has led her to help thousands of families become homeowners. Angela expanded her expertise and became a Certified Divorce Financial Analyst (CDFA®) and also a Certified Divorce Lending Professional (CDLP) where she researches guidelines and niches for borrowers going through divorce and the realtors and attorneys who work with them. She has also been the recipient of several accolades throughout her career. Including, Top 1% Mortgage Originators by Mortgage Executive Magazine, Top 200 Originators by Scotsman Guide and a PrimeLending multi-year Power Producer. She has also won D Magazine Top Lender for the past 3 years.

Who are we?

Marissa &

James Greco

Are dedicated to helping women navigate the financial complexities of pre and post-divorce life. As fiduciary financial planners and Certified Retirement Specialists, we bring 10 years of experience, industry knowledge, and personalized guidance to empower women during this challenging time. Our mission is to help you achieve financial security and independence through personalized financial planning and sound wealth management strategies.

Angela Deaton

A dedicated Senior Loan Officer who loves helping borrowers reach their goals. Although she and her team are located in the heart of Dallas, Texas – they finance loans all across the country. With a vast knowledge of different loan products, The Deaton Team focuses on educating clients about their options and guiding them through the home loan process. Angela got her start in the mortgage industry over 19 years ago, and her commitment has led her to help thousands of families become homeowners. Angela expanded her expertise and became a Certified Divorce Financial Analyst (CDFA®) and also a Certified Divorce Lending Professional (CDLP) where she researches guidelines and niches for borrowers going through divorce and the realtors and attorneys who work with them. She has also been the recipient of several accolades throughout her career. Including, Top 1% Mortgage Originators by Mortgage Executive Magazine, Top 200 Originators by Scotsman Guide and a PrimeLending multi-year Power Producer. She has also won D Magazine Top Lender for the past 3 years.

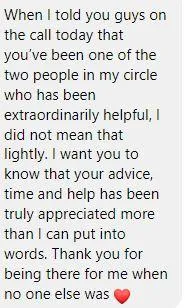

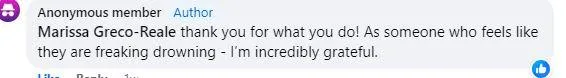

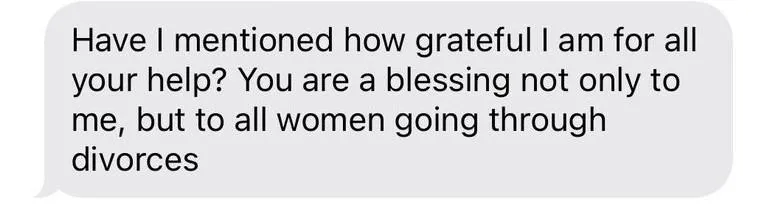

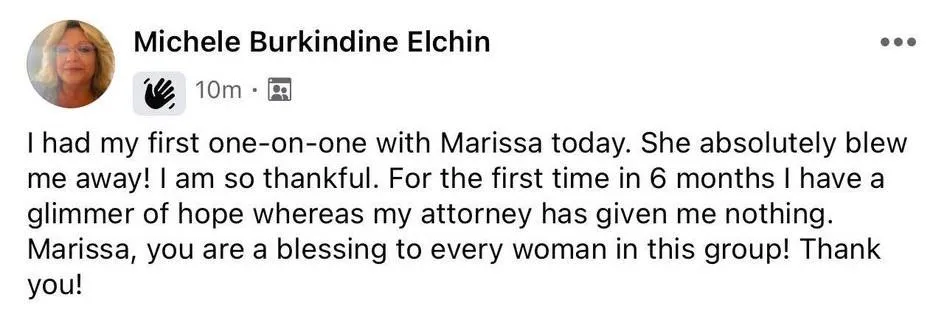

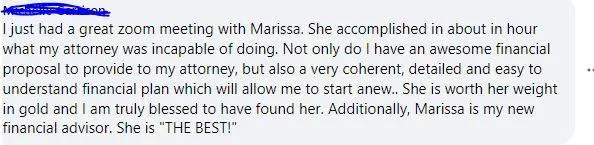

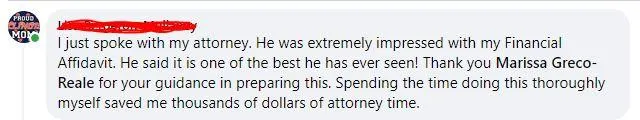

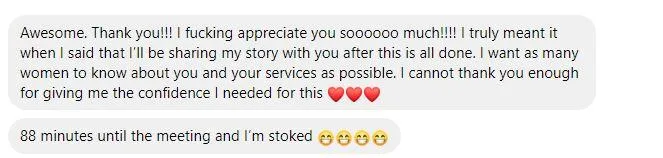

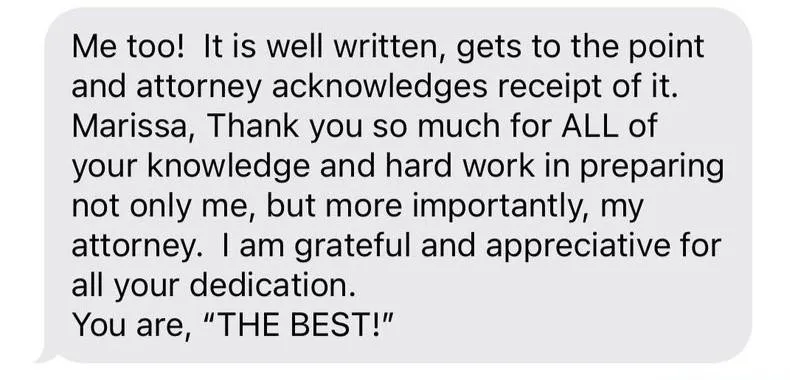

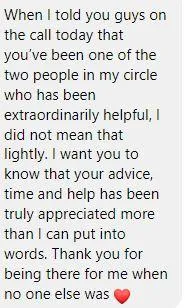

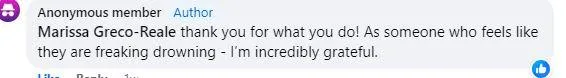

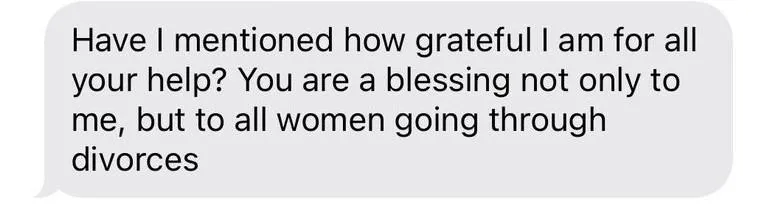

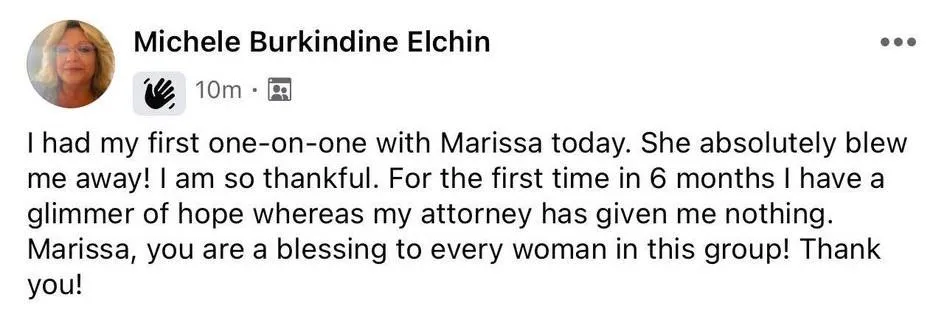

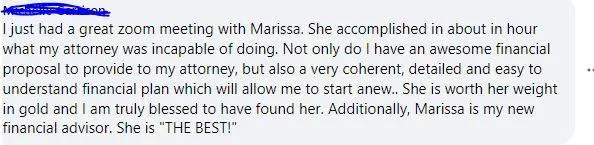

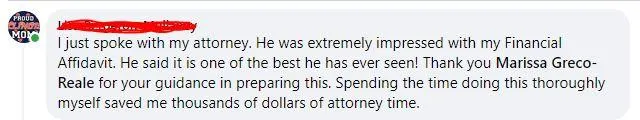

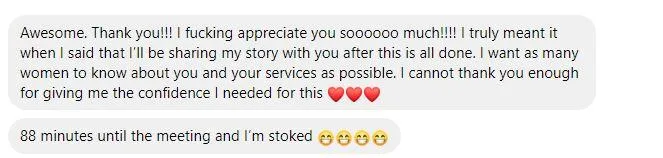

Testimonies from divorced women

we have helped throughout their negotiation

"I have found a financial advisor that truly cares and has full knowledge of the industry and as a certified divorce financial divorce advisor, I believe I have the best person in my corner. I've received access to numerous guides and information I would have never received from my attorney, even though she is extremely good, which I have created a financial foundation, with Marissa's extensive guides, and I continue to build on and am becoming more knowledgeable in creating a sound financial case for my divorce. I've presented documents, from Marissa's guides, to give to my attorney which have enabled me to be the utmost prepared. I have been educated by Marisa on topics I had no previous knowledge on. I am asking my attorney questions that I would have never known and am now advocating for myself to get the most lucrative settlement from my divorce, even though it is going to court. I am clarifying details on QDRO's, taxes, COLA's, and just as important as the divorce settlement, I am being educated about after my divorce. How to invest my money, and if I need access to money, how to get access to cash without being fully taxed or penalized. Every penny counts towards your future and how to survive on a reduced budget that you may not be used too."

— TRACY

"To all the women out there who are feeling worn down and emotionally exhausted from the idea of divorce or from the divorce process, keep your head up. Be strong and confident even when you feel like you don’t have a reason to be. As they say “fake it till you make it.”

I thought the strength I had back in August to file for divorce was enough to get me through this process. But I quickly learned that this was going to be a lot harder than I ever imagined. There were times I was discouraged and shut down but I knew deep down that if I gave up or gave in that I would be agreeing to decisions that wouldn’t serve me well for the rest of my life.

One of the things that has given me more confidence and strength has been the education that Marissa has given in this group. I knew where my weaknesses were in this process, which was financial literacy so I made the decision to begin working with Marissa as a client after seeing how valuable her advice was in this group. After working with her and her team I can tell you that the help they’ve provided me and the empowerment they gave me has paid off far more than I can even put into words.

I told Marissa that once my divorce was final I would blast every social media page I have about her and all the help she’s given me. But after the MANY things she’s done to help my case thus far, I couldn’t wait to share with all of you how valuable it is to KNOW your numbers when going into your mediation/negotiation meetings.

I had ZERO clue what to ask for in spousal support and no idea that it mattered where I took the money from when dividing the assets 50/50 due to certain tax implications. I just thought “yeah, 50/50 sounds good,” and that was the extent of my input prior to speaking with Marissa and her team.

After Marissa rushed to get my financials in order for my first financial mediation meeting, I shared them with my legal team and I was immediately blindsided by a barrage of questions and concerns about who, what, and where I got this information from. They made me feel like what I had presented was terrible and so I decided to be silent the remainder of the meeting until I could reconnect with Marissa. Turns out my legal team wasn’t upset by what I had presented them, it seemed as if they were upset that I hadn’t used THEIR services to come up with the data Marissa provided me. They lost out on billable hours and it didn’t sit well with them.

After a few weeks of arguing with my legal team and presenting the data Marissa provided again, they agreed it was good but suggested that my husband wouldn’t agree to it. I decided to reach out to my husband to request that we discuss spousal support outside of our mediation meetings to save on legal fees and after staying confident and firm with the data Marissa gave me, he finally agreed to a settlement just above my bottom line number. Without going into the details, his original offer was only 15% of what we actually agreed on.

I know I may be in different position than some of you in the timeline of my divorce but just know that in those moments when you feel hopeless and life doesn’t seem fair, keep your head up and dig deep for the strength and confidence to get you over the hurdles ahead.

As for Marissa and her team, if you’re in a position where you need further financial guidance or education for your divorce case, I cannot recommend Marissa enough. There are no words to describe how amazing and genuine this woman is. When I felt stuck and confused by the numbers being thrown at me, she not only educated me on everything but she gently explained it to me in a way that I would understand. Her approach was everything I needed in my situation. I hope I have the opportunity to be in a financial position one day to gift someone the services she provides. It’s so common that one spouse, typically the wife, is in the position of being financially illiterate and I was that person. It’s not something to be ashamed of but it’s taught me that financial literacy is so important and I can’t tell you how grateful I am for finding Marissa on TikTok months ago to help me be in a position where I’m not ignorant to my financial situation anymore.

Marissa, I know I’ve said this to you in private many times but I want to say thank you for all that you’ve done and continue to do. I truly appreciate you more than I can ever put into words. You have given me confidence, knowledge and support when no one else did. A few months ago I felt discouraged and lost. There were many times where I almost gave in to decisions that would have hurt me financially for years. But thanks to you and your entire team, I have been given a life that I can feel confident in. I wish you and your family all the blessings in the world for all that you do for all of us."

— ADRIENNE

Testimonies from divorced women

we have helped throughout their negotiation

"I have found a financial advisor that truly cares and has full knowledge of the industry and as a certified divorce financial divorce advisor, I believe I have the best person in my corner. I've received access to numerous guides and information I would have never received from my attorney, even though she is extremely good, which I have created a financial foundation, with Marissa's extensive guides, and I continue to build on and am becoming more knowledgeable in creating a sound financial case for my divorce. I've presented documents, from Marissa's guides, to give to my attorney which have enabled me to be the utmost prepared. I have been educated by Marisa on topics I had no previous knowledge on. I am asking my attorney questions that I would have never known and am now advocating for myself to get the most lucrative settlement from my divorce, even though it is going to court. I am clarifying details on QDRO's, taxes, COLA's, and just as important as the divorce settlement, I am being educated about after my divorce. How to invest my money, and if I need access to money, how to get access to cash without being fully taxed or penalized. Every penny counts towards your future and how to survive on a reduced budget that you may not be used too."

— TRACY

"To all the women out there who are feeling worn down and emotionally exhausted from the idea of divorce or from the divorce process, keep your head up. Be strong and confident even when you feel like you don’t have a reason to be. As they say “fake it till you make it.”

I thought the strength I had back in August to file for divorce was enough to get me through this process. But I quickly learned that this was going to be a lot harder than I ever imagined. There were times I was discouraged and shut down but I knew deep down that if I gave up or gave in that I would be agreeing to decisions that wouldn’t serve me well for the rest of my life.

One of the things that has given me more confidence and strength has been the education that Marissa has given in this group. I knew where my weaknesses were in this process, which was financial literacy so I made the decision to begin working with Marissa as a client after seeing how valuable her advice was in this group. After working with her and her team I can tell you that the help they’ve provided me and the empowerment they gave me has paid off far more than I can even put into words.

I told Marissa that once my divorce was final I would blast every social media page I have about her and all the help she’s given me. But after the MANY things she’s done to help my case thus far, I couldn’t wait to share with all of you how valuable it is to KNOW your numbers when going into your mediation/negotiation meetings.

I had ZERO clue what to ask for in spousal support and no idea that it mattered where I took the money from when dividing the assets 50/50 due to certain tax implications. I just thought “yeah, 50/50 sounds good,” and that was the extent of my input prior to speaking with Marissa and her team.

After Marissa rushed to get my financials in order for my first financial mediation meeting, I shared them with my legal team and I was immediately blindsided by a barrage of questions and concerns about who, what, and where I got this information from. They made me feel like what I had presented was terrible and so I decided to be silent the remainder of the meeting until I could reconnect with Marissa. Turns out my legal team wasn’t upset by what I had presented them, it seemed as if they were upset that I hadn’t used THEIR services to come up with the data Marissa provided me. They lost out on billable hours and it didn’t sit well with them.

After a few weeks of arguing with my legal team and presenting the data Marissa provided again, they agreed it was good but suggested that my husband wouldn’t agree to it. I decided to reach out to my husband to request that we discuss spousal support outside of our mediation meetings to save on legal fees and after staying confident and firm with the data Marissa gave me, he finally agreed to a settlement just above my bottom line number. Without going into the details, his original offer was only 15% of what we actually agreed on.

I know I may be in different position than some of you in the timeline of my divorce but just know that in those moments when you feel hopeless and life doesn’t seem fair, keep your head up and dig deep for the strength and confidence to get you over the hurdles ahead.

As for Marissa and her team, if you’re in a position where you need further financial guidance or education for your divorce case, I cannot recommend Marissa enough. There are no words to describe how amazing and genuine this woman is. When I felt stuck and confused by the numbers being thrown at me, she not only educated me on everything but she gently explained it to me in a way that I would understand. Her approach was everything I needed in my situation. I hope I have the opportunity to be in a financial position one day to gift someone the services she provides. It’s so common that one spouse, typically the wife, is in the position of being financially illiterate and I was that person. It’s not something to be ashamed of but it’s taught me that financial literacy is so important and I can’t tell you how grateful I am for finding Marissa on TikTok months ago to help me be in a position where I’m not ignorant to my financial situation anymore.

Marissa, I know I’ve said this to you in private many times but I want to say thank you for all that you’ve done and continue to do. I truly appreciate you more than I can ever put into words. You have given me confidence, knowledge and support when no one else did. A few months ago I felt discouraged and lost. There were many times where I almost gave in to decisions that would have hurt me financially for years. But thanks to you and your entire team, I have been given a life that I can feel confident in. I wish you and your family all the blessings in the world for all that you do for all of us."

— ADRIENNE

Why Choose Marissa & James Greco

as Your Financial Planners?

When you work with Marissa & James Greco, you can expect:

A Fiduciary Commitment: As fiduciaries, we prioritize your financial interest above all else. Our transparent and unbiased advice is always designed to help you reach your unique goals.

Industry Expertise: As Certified Retirement Specialists (CRPC) and Certified Divorce Financial Analyst (CDFA) we offer a wealth of knowledge and experience in retirement planning, tax strategies, and wealth management to secure your financial future. We both each have our series 7, 66 and health and life insurance licensing.

Personalized Guidance: We take the time to understand your individual circumstances, goals, and concerns, and create a customized financial plan to protect and grow your wealth.

Compassionate Support: We pride ourselves on providing care, empathy, and understanding to ensure you feel confident and secure when making life-changing financial decisions.

Whether you're facing the uncertainties of pre or post-divorce life or simply looking to secure your financial future, Marissa and James Greco are here to help you every step of the way.

Why Choose

Marissa & James Greco

as Your Financial Planners?

When you work with Marissa & James Greco, you can expect:

A Fiduciary Commitment: As fiduciaries, we prioritize your financial interest above all else. Our transparent and unbiased advice is always designed to help you reach your unique goals.

Industry Expertise: As Certified Retirement Specialists, we offer a wealth of knowledge and experience in retirement planning, tax strategies, and wealth manage to secure your financial future.

Personalized Guidance: We take the time to understand your individual circumstances, goals, and concerns, and create a customized financial plan to protect and grow your wealth.

Compassionate Support: We pride ourselves on providing care, empathy, and understanding to ensure you feel confident and secure when making life-changing financial decisions.

Whether you're facing the uncertainties of pre or post-divorce life or simply looking to secure your financial future, Marissa and James Greco are here to help you every step of the way.

©2024 Get Divorce Ready. All Rights Reserved.

Welcome to our website! We are glad you have chosen us for your needs related to divorce consulting services. Before using our services, we request that you read and understand the following Terms and Conditions and Privacy Policy. By accessing or using our services, you agree to be bound by these terms.

Terms and Conditions Services: Our website offers divorce consulting services to assist individuals in navigating the divorce process. Our services include consultations, document preparation, and general guidance on financial matters related to divorce. Kindly be advised that we are not tax advisors or attorneys. It is crucial that you seek guidance from your legal and tax team throughout your case. The insights we offer are solely for informational purposes.

Refund Policy: Due to the nature of our consulting services, which include personalized expertise and significant preparatory work, we maintain a strict no-refund policy. Upon the commencement of our contract, clients agree to this policy, acknowledging that all payments are final. We encourage clients to review all terms and conditions carefully and make informed decisions before entering into a contract with us.

Cancellation Policy: We recognize that circumstances may change, and a client might need to cancel their consulting package. While refunds are not always available, we approach cancellations with a prudent case-by-case examination. If you need to request a cancellation, please follow these steps:

1. Written Notification: Submit a cancellation request by reaching out to us via email. Please provide your name, contact information, and a detailed explanation regarding your reason for cancellation.

2. Review Process: Upon receiving your email, our team will promptly review the request. We consider the progress of the consulting services, time invested, and any other relevant factors when evaluating cancellation requests.

3. Resolution: After a thorough review, we will contact you with a resolution. We strive to find amicable solutions that respect the interests of both parties involved.

Client Responsibilities: By using our services, you agree to provide accurate and up-to-date information about your case. You are responsible for any consequences that may result from providing false or incomplete information.

Consultations: Consultations are conducted by our experienced consultants to provide guidance and answer questions related to your divorce case. The information provided during consultations is not considered legal advice and should not be relied upon as such.

Document Preparation: Our website offers document preparation services to help you complete necessary paperwork for your divorce. However, we are not responsible for the outcome of any legal proceedings that may result from the use of our document preparation services.

Payments: Payment for our services is required upfront before any work is performed. We accept credit card, debit card, and PayPal payments. In the event that a payment is declined, we reserve the right to refuse or terminate our services.

Privacy Policy: At our website, we take your privacy seriously. We collect personal information only when it is voluntarily provided by you, such as during consultations or through our document preparation services. This information is used solely for the purpose of providing our services to you and will not be shared with third parties without your consent.

Information Security: We take all necessary precautions to protect your personal information from unauthorized access or disclosure. However, please note that no method of transmission over the internet or electronic storage is 100% secure and we cannot guarantee absolute security.

Links to Third-Party Websites: Our website may contain links to third-party websites for your convenience. However, we do not endorse or assume any responsibility for the content or privacy policies of these websites. We encourage you to review the privacy policies of any third-party websites before providing them with your personal information.

Changes to This Policy: We reserve the right to modify this privacy policy at any time without prior notice. Any changes will be effective immediately upon posting on our website. It is your responsibility to review this policy periodically for any updates or changes.

Contact Us: If you have any questions or concerns about our privacy policy, please contact us at [email protected]. For any further assistance you can contact Marissa Greco directly via Phone at 973-896-5143.

We value your feedback and will do our best to address any issues promptly.

Thank you for choosing our services and trusting us with your personal information